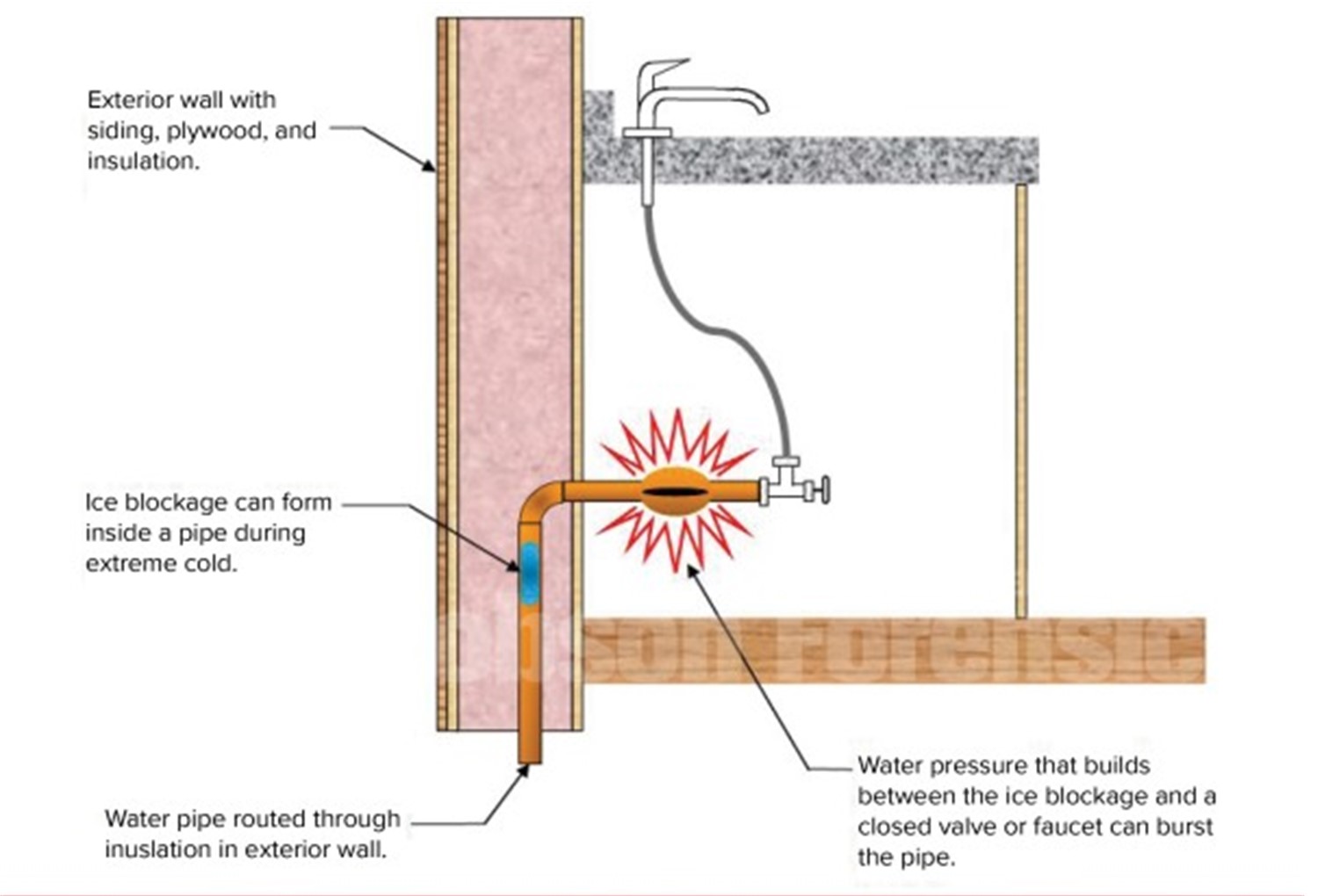

Freezing temperatures can be the most common culprit of burst pipes. When water freezes, it expands, which can cause the pressure inside the pipe to increase until it bursts.

What causes water pipes to freeze?

A few locations where pipes freeze most commonly are outdoor hose bibs, swimming pool supply lines, fire protection lines, and water supply pipes in unheated interior areas, which include basements, crawlspaces, attics, garages, bathroom sink cabinets, and kitchen cabinets. Pipes along exterior walls with little or no insulation, voids in the insulation, or improperly installed building wrap are also subject to freezing. One of the most common causes of frozen burst pipes in Michigan is when homeowners and business owners turn the heat down in their homes/business’ below recommended temperatures and leave for an extended period of time with nobody around to monitor the dwelling. This is also one of the causes for these claims to be denied.

Does my insurance policy cover the cost of repairing the broken pipes, or am I responsible?

In general, homeowner’s and commercial property insurance does cover water damage caused by a burst pipe, but NOT the damage to the pipe itself or plumbing equipment. Depending on the Insurance Company, there are specific situations when they WILL cover repair pipes that have frozen and then burst. We recommend that these questions are asked of your insurance agent.

What types of damage can I expect from a failed sump pump?

Repairs for this type of claim are scheduled after the pipes are repaired and the confirmed dry-out of all affected materials by Zolman’s Mitigation Team. When a pipe bursts, it’s critical to get the water shut off as quickly as possible to help prevent further damage. After turning off the water, you want to contact a plumbing company to come out as soon as possible to address the issue. Depending on the location of the burst pipe, all sorts of interior damage are possible. The quicker you get the water shut off from the time of the incident, the greater chance you have to mitigate losses in the affected.

What does insurance typically cover?

Most homeowner and commercial property insurance policies, in general, will cover damage from a frozen pipe that bursts. Coverage usually exists if the policy contains the following or similar language: Coverage is provided when it is determined damage resulted from a “sudden and accidental” discharge from a plumbing source or system (please check your policy for the exact language). There is, however, one caveat—your insurance policy may not respond if it appears you neglected to take the proper steps to safeguard your property. Your policy usually requires that heat be maintained within the property, and some policies require that you maintain a certain temperature, even if the property is vacant, occupied, or unoccupied. You may not be eligible for insurance coverage for plumbing, heating, air conditioning, automatic fire protection, or household appliances if it can be determined that the insured did not take precautions to maintain the property to prevent freezing.