During heavy rains, flooding, or storms, sewage backups may occur. A blockage in a basement drain may not indicate a problem with your plumbing fixtures or sewer line. Instead, they can happen when the city sewer system is inundated with water after a heavy rain shower.

Identify the reasons that they may exist :

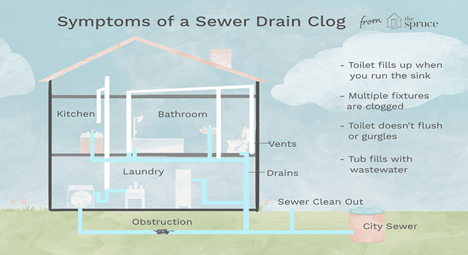

Sewage can back up into your home or business when your property’s drain pipes or main sewer line becomes clogged. For example, if one toilet creates a sewage backup, the drain connected to that toilet will likely be clogged. But if all toilets or bathtubs in your home or business create backflows, then there may be a clog in the main sewer line, or the sump pump may fail. Clogs can consist of hair, grease, tree roots, or other solid materials that end up in the drains. Damaged pipes are the most extreme cause of a sewage backup, and in these situations, the culprit is usually tree root intrusion, cracks, and offset joints.

Who removes the blockage or completes the pipe repair?

Blockages are traditionally cleared by “snaking the drain line,” which is something most plumbers or sewer repair companies handle.

What kind of interior damages can be expected from a sewage backup?

All backups are different and do not always cause much internal damage to the home’s or business’ structure. Some backups, if not addressed promptly, may result in a few inches of standing water in the basement. Category 3 water, also known as dirty water, can cause the removal of building materials such as flooring, moldings, doors, drywall, plaster, cabinets, personal property, etc.

What does insurance typically cover?

Most homeowner and commercial property insurance policies explicitly state that any damage caused by a sewage backup will not cover what the water or raw sewage destroys and will not be qualified for replacement from the insurance company. Water backup coverage is an optional add-on to a homeowner’s insurance policy. This coverage may help pay for water damage from a backed-up drain or sump pump. For instance, it may help cover the cost of replacing furniture or removing water after an unexpected backup. Some of these additional policies will only have a cap of $5000.00 – $10,000.00, though. We strongly recommend speaking with your insurance agent and ensuring you are well informed on what is and what is not covered under your policy. Too often, we see that insureds are underinsured and were unaware of their coverage until it was too late.